Local Business Loans - An Alternate To Standard Funding Options

Article writer-Lindahl Knight

Small business loans are an excellent choice for increasing financing for an organization startup. Small company startup finances are unsafe financings supplied by private lending institutions to a business owner for taking care of company activities. https://labusinessjournal.com/news/2021/mar/08/small-business-loans-8-programs-la-businesses/ -up car loans are made use of to perform everyday business deals. Small business funding also describes the methods whereby a hopeful or currently existing business owner gets cash to begin a brand-new organization, get an existing organization or infuse capital into an already established company to fund future or current service activity.

Cash flow is the major resource of functional funds for many services, especially for start-ups. To increase funds for capital enhancement, local business owners consider a selection of options. One of these options is to get instantaneous money from family and friends. This might not be the best way as your buddies might not have the exact same line of assuming as an establishment which offers bank loan. https://writeablog.net/corrine241shirlee/small-company-loans-3-points-you-should-know-prior-to-you-register of the moment, individuals need to borrow cash against their house equity to increase start-up cash money.

An additional alternative for local business owner seeking bank loan is to secure a loan from the Small Business Administration or SBA. The Small Company Administration, also referred to as the SBA, is a government company that was set up to assist entrepreneurs in America with developing, operating and also increasing companies. The SBA assurances lendings to organizations that satisfy pre-defined requirements, such as having less than one year of operation.

https://postheaven.net/amber28fabian/local-business-loans-an-alternative-to-typical-financing-alternatives -up Loans rate of interest vary according to the lender. Financial institutions are thought about prime loan providers as a result of their long-lasting relationship with the United States economy. Prime lenders are ranked by the government. If you prepare to get a loan from a bank, it is necessary to recognize how your interest rate will certainly be identified. You can discover this out during a pre-approval meeting where the bank reps collect all the details about your service strategy, your credit rating and the amount of money you have in the bank.

Considering that a lot of financial institutions have an inspecting account, they are great resources of starting capital for organizations. Local business can also obtain various other commercial financings from the financial institution's online system. Several financial institutions additionally offer a reduced rates of interest for those that obtain a secured loan. A common option for a protected finance is a residence equity lending, which is based on the value of a house.

Rate of interest are also a consideration when requesting a bank loan. It is constantly good to get quotes from different loan providers to contrast the price they would certainly charge for the amount of money you need to obtain. Some banks will certainly also use unique deals and reduced interest rates for brand-new companies. The dimension of the business and its history will likewise influence the cost you will be asked to spend for a financing. Larger companies have much better access to resources and have been developed for a longer time period.

To look for a bank loan with the Small company Management, or SBA, you will have to give personal in addition to company information. You will certainly likewise be required to supply employment information as well as any type of evidence of collateral you have for your funding. You will certainly require to be accepted for financing through the SBA prior to you can use it for your service. The SBA has unique programs that you can utilize to aid you get accepted quicker.

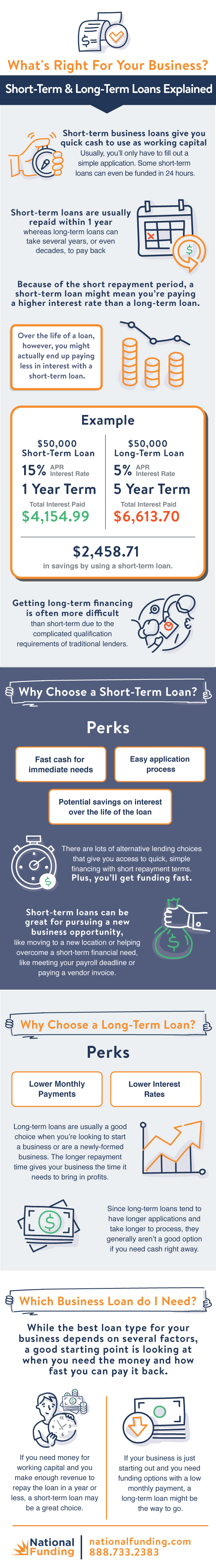

Small business loans are normally short-term as well as can be renewed by the loan provider. This helps business owners who have troubles discovering standard financing for their business. Small business loans can help boost the capital of a service swiftly as well as substantially without the inconvenience of long-lasting funding plans.